The days of $20 copays for Americans are coming to an end. It's time we become more proactive with our healthcare.

In today's market where health insurance is often time unavailable or unaffordable if not qualifying for a subsidized premium through the healthcare marketplace, a defined benefit plan can help provide you and your family with a peace of mind by proving health insurance benefits can be affordable. The idea behind this plan it provide a plan that is affordable, with quality healthcare if the consumer has basic knowledge and willingness to make informed decisions by discussing your treatment plan and costs with the healthcare professional of your choice.

.

The key to controlling your healthcare costs are simple. It is dependent on choosing the "right" plan at the right time to help guide your decisions and have a better understanding of the healthcare benefits within your plan..

Behind the scenes of the U.S. Healthcare system...

Across the U.S. there are wonderful and amazing healthcare professionals committed to their profession of caring for you. Unfortunately, behind the scenes, there are industry and government stakeholders who are undermining and exploiting the entire healthcare system for their own financial gain.

Insurance companies get huge discounts on hyper-inflated prices, while the average individual with no group insurance is charged an unregulated price and then sued and bankrupted when they cannot pay their medical bill.

Our Core Values

1

Transparency:

On pricing and the actual benefits and coverage of our plans

4

Support:

On-going support for our customers long after the sale. We provide year-long customer support with their benefit utilization

2

Affordability:

Making sure that people have access to affordable solutions other than major medical

3

Family:

We believe families have enough relational and financial challenges without adding the additional stress of healthcare costs to the list. We want to help put as much money back into family's checkbooks as we can

5

Education:

We ensure our clients and partners are provided with the necessary tools and information and needed to empower them with the control to manage their healthcare spending

6

Partnerships:

Partnerships build the allies needed to accomplish change on a national level...and they need us

Key Features Include

A $5,000,000 LIfetime Maximum

-

Choose the plan that is best for you from Two Benefit Options (Gold or Silver)

-

Pick From 3 Inpatient Deductible Options ($1,000, $2,500, or $5,000)

-

Select Level of Benefit That Best Fits Your Healthcare Needs and Budget

-

Choose Your Annual Benefit Maximum ($100,000, $250,000, or $1,000,000)

In-Network vs. Out of Network Coverage:

In-network providers have agreed to a discounted rate on services charges for network members (you!). Our plan is part of the Aetna's First Health PPO network (3rd largest network in the U.S.) we’re confident you’ll be able to find excellent providers.

If your preferred provider isn’t In-network with the First Health Network, you can continue to use your benefits, unlike most other insurance plans that do not provide out-of-network coverage or penalizes you when you step outside of the network. WIth our plan you can truly see ANY provider you choose. To ensure you get the best rates, you may need opt to pay cash for your service, but your plan will always reimburse you the full benefit amount you are entitled to.

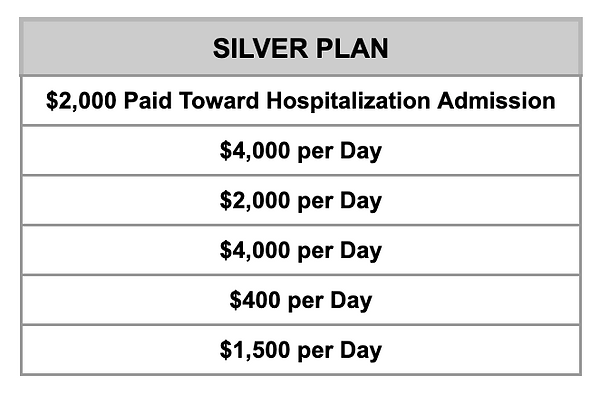

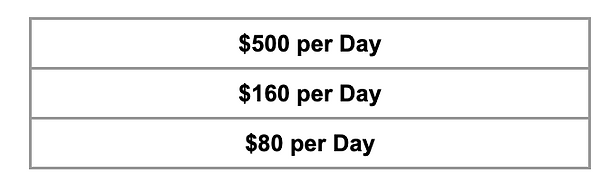

In-Patient Hospitalization Services

Inpatient confinement benefits are payable when confined for 24-hours or more. Does not include Mental Illness, Alcohol and/or Substance Abuse dependency.

Additional Hospital Admission Benefit

One benefit day per insured per Calendar Year.

Confinement in Hospital resulting from covered illness or injury

Confinement in Hospital's Intensive Care Unit (ICU)

Up to 20 days per Calendar Year and paid in addition to hospital confinement benefit.

Observation Unit Stay of a Hospital - 24 hours or more

Confinement in Hospital for Mental Illness, Alcohol/Substance Abuse - 30 day maximum.

Confinement in Rehabilitation or Skilled Nursing Facility

Hospital Confinement Increase Benefit:

By adding this optional benefit, your benefit amount will double the daily inpatient hospital confinement benefit for the first 3 inpatient days.

Optional Inpatient Benefit Add-On

Not Sure What a Typical Day in the Hospital Costs

Below is a U.S. map showing the average cost per day for a hospitalization for each state in 2024.

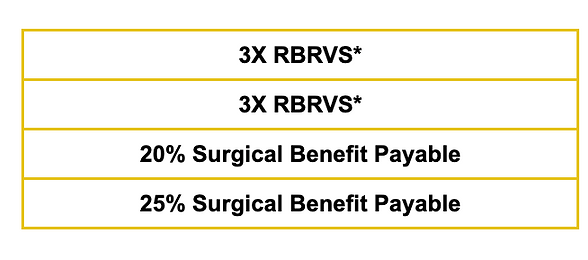

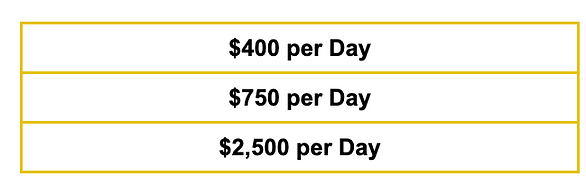

Inpatient Professional Services

Inpatient Physician's Care Benefit

When medical care is from a physician other than the operating surgeon

Professional Services

Surgeon Benefit for Services Performed in Hospital/ Surgical Center

Inpatient Pathology / Radiology Benefit

Assistant Surgeon Benefit

Anestesiologist Benefit

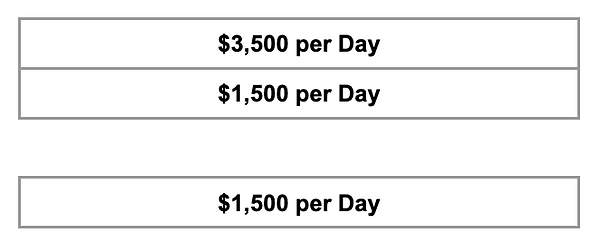

Outpatient Ambulatory Surgical Center

Benefit for Surgery Performed Requiring General Anesthesia

Benefit for Surgery Performed Requiring Local Anesthesia

Outpatient Radiation Therapy, Chemotherapy, or Immunotherapy

Per Day/ 40 days per Calendar Year

Physician and Specialist Benefit

For each day an insured sees a Physician/ Specialist in office or clinic.

Therapy and Chiropractic Benefit

Including but not limited to physical, speech, and occupational therapy.

Surgery Benefit in a Physician's/ Specialist's Office or Clinic

MRI, PET, CAT Scan or Other Nuclear Testing

X-Rays or Other Diagnostic Testing Benefit

Laboratory Benefit

Outpatient Services

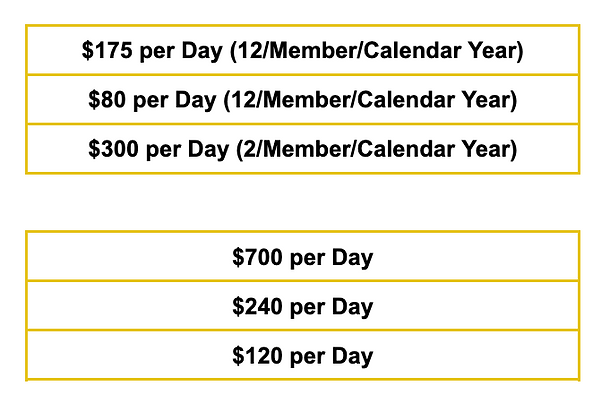

Injection Benefit

Including but not limited to shots & immunizations for adults and children.

Preventative Care Benefits

-

All Preventative Benefits have a 60-day waiting period per insured from the effective date of coverage before benefits will be paid.

-

Not subject to "Pre-existing" exclusions.

Mammograms - Limit one (1) benefit per insured per Calendar Year

Colonoscopy or Sigmoidoscopy - WIthout finding any polyps - Includes up to 1 day every 3 Calendar Years. If polyps are found colonoscopies are paid under eligible outpatient surgery benefit.

All Other Preventative Care Services - Including but not limited to annual physical, pap smears, PSA tests, cholesterol screening and x-ray. Limit one (1) benefit per insured per Calendar Year.

$250

$300

$600

$700

$250

$300

Urgent Care / Emergency Room Services

Urgent Care / Emergency Room Benefit

Maximum of 4 combined Urgent Care/ Emergency Room Benefits per Year

Ground Ambulance Benefit

Maximum of 2 benefits per year

Air Ambulance Benefit

Maximum of 1 benefit per year

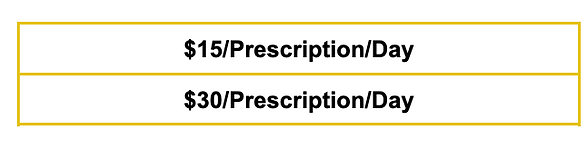

Prescription Benefits

Generic Prescription Benefit

Per Insured per prescription filled

Brand Prescription Benefit

Per Insured per prescription filled

Added Benefits Built To Ensure You Are Protected

Specified Disease Coverage

No health insurance is perfect and provides 100% coverage. Some medical conditions can have a major financial impact and leave you with unexpected out-of-pocket costs. Our Specified Disease Insurance helps to cover inpatient and outpatient treatment costs of up to 1 million dollars, for over 20 different conditions. The Specified Disease Insurance helps to fill in those gaps left by your Defined Benefit Plan.

Critical illness insurance coverage generally provides a lump sum payment if the insured is diagnosed with a covered critical illness, offering financial support during a difficult time. This coverage is designed to help with out-of-pocket expenses and other costs related to treatment and recovery, supplementing regular health insurance.

Choose From 5 Benefit Options

$10,000

$20,000

$30,000

$40,000

$50,000

Covered Conditions

-

Cancer

-

Heart Attack

-

Kidney Failure

-

Major Organ Transplant

-

Permanent Paralysis

-

Severe Burns

-

Stroke

-

Coronary Artery Bypass

-

Heart Valve Replacement or Repair

-

Pacemaker Implantation

-

Angioplasty

Full access to the NATIONAL CONSUMERS BENEFITS ASSOCIATION or "NCBA" Benefits ($79.99 value): NCBA is a national not-for-profit association that provides individuals at small businesses and the self-employed consumer benefits, services and health-related purchases, including access to over 40 valuable association endorsed benefits.

Below are just a few of the exciting benefits included in the NCBA.

Health Savings

Unlimited Access to 24/7 Telemedicine

$10,000 Accident Medical Expense (per member)

$100,000 AD&D Policy

$10,000 Term Life Insurance Policy

Aetna's Dental Access

Consumer Savings

Legal Services

SafetyNet Child ID

All-State Identity Protection

SPOT Pet Insurance

Travel Savings

Roadside Assistance

Travel Assistance

Car Rental Discounts (Avis & Budget)

Cruise Only

Our mission is to provide benefits that will contribute to a richer, more fulfilling life for every NCBA Member.